Abstract

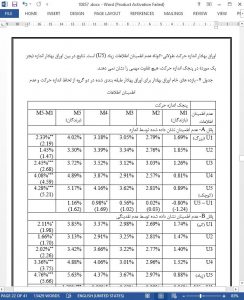

We examine the role of fundamental accounting information in shaping portfolio performance. Using a conditional performance approach, we address the concern that the positive relation between Piotroski’s F Score and ex post returns is due to risk compensation. Our results show that portfolios of firms with strong fundamental underpinnings generate significant positive and time-varying performance. One potential source of these performance gains is an underreaction to public information (such as momentum and F Score) when information uncertainty (proxied by size, illiquidity, and idiosyncratic volatility) is high. In addition, conditional performance benefits seem prevalent in periods of high investor sentiment.

I. Introduction

There is extensive and long-standing support for the use of fundamental valuation tools in equity choice from the early seminal work of Graham and Dodd (1934) to the current investment philosophy of their modern adherent Warren Buffett.1 In addition, numerous authors document the potential economic benefits of fundamental analysis through the judicious use of available financial accounting information (cf. Ou and Penman 1989; Lev and Thiagarajan 1993; Haugen and Baker 1996; Asness 1997; Frankel and Lee 1998; Griffin and Lemmon 2002; Piotroski 2000; Mohanram 2005; Piotroski and So 2012; Novy-Marx 2013).

IV. Concluding Comments

We apply conditional performance evaluation to fundamental accounting-based information measures in the spirit of Graham and Dodd (1934), Lev and Thiagarajan (1993), and Piotroski and So (2012). We find strong evidence of significant conditional performance after corrections for risk differences. Our approach produces point estimates of performance along with related inferences that vary over time and across economic states. We find little empirical support for the Fama and French (2006) critique that strong fundamental firms may simply offer superior returns as compensation for greater risk.