Abstract

Purpose – The purpose of this paper is to develop arguments for a public policy of requiring all large companies to make their tax returns publicly available. It is argued that such a policy would help to check tax avoidance, strengthen public accountability and secure fair competition.

Design/methodology/approach – The policy proposal rests on notions of transparency and public accountability.

Findings – The paper argues that the proposed policy is feasible.

Research limitations/implications – The paper hopes to stimulate debates about the value of public filing of corporate returns and limits of public accountability.

Social implications – The paper extends the range of public policies which might be able to check organised tax avoidance.

Originality/value – It is one of the few papers to call for public filings of large company tax returns.

Introduction

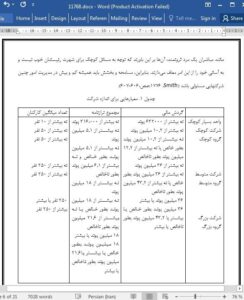

Tax avoidance is a matter of public concern as it disables the capacity of democratically elected governments to meet policies mandated through the ballot-box, including the mandate to invest in social infrastructure and redistribute income and wealth to secure social stability. Due to secrecy and opacity, the amount of tax avoided/evaded is hard to know. In all, 28 member states of the European Union (EU) are estimated to be losing around one trillion euros each year (Euronews, 2013). It is estimated that between $7.6 and $32 trillion of the world’s wealth is hidden away in low/no tax jurisdictions and escapes tax altogether (Henry, 2012; Zucman, 2015).

Summary and discussion

This paper has sought to argue that the public filing of the tax returns of large companies, together with related information, will help to check tax avoidance. It will strengthen parliamentary and public scrutiny of corporations and tax authorities. Increased transparency and public accountability would exert pressure on companies to clean up their practices. Public filing of the tax returns of large companies would also improve competition. Still, some opponents would raise the spectre of the cost of public filings, even though they are likely to be minuscule. Such opponents usually neglect the social costs associated with secrecy. In the absence of public filings, companies would continue to indulge in damaging tax avoidance practices and undermine public revenues which would either require citizens to pay higher taxes or forego hard-won social rights, neither of which is conducive to social welfare or long-term social stability.