Abstract

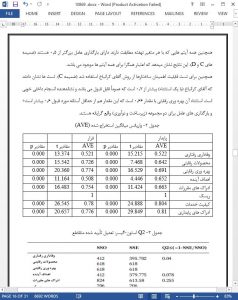

The purpose of this research is to investigate predictors of customer loyalty in order to identify alternatives to customer satisfaction with service quality, which has been traditionally accepted as the primary predictor of customer loyalty, particularly for services. A stratified sample of bank customers was surveyed to collect information on customer perceptions and behaviors in relation to satisfaction with service quality, competitiveness, risk, regulation, stability and loyalty. Partial least squares path modelling (PLSPM) was applied to develop loyalty models for a steady market (Australia) and a volatile market (Greece). This study's empirical findings support theoretical arguments for the inclusion of customer perceptions of competitiveness in loyalty modelling. Perceptions of regulation and stability intervene in the relationship between drivers of loyalty and loyalty itself. For bankers, the study emphasizes the need to move away from customer satisfaction with service quality to explain customer loyalty, towards focusing efforts on achieving relative superiority in competitiveness, namely competitive productivity and products. Profiling customers based on their perceptions of a bank's competitiveness can provide additional explanatory power beyond traditional satisfaction based loyalty models. Services marketing has focused on the service components, and there is no doubt about its crucial role. But given this focus, other factors, such as the actual product component, have been somewhat overlooked in services research. The study makes a unique contribution to understanding and modelling customer loyalty by demonstrating the importance of the inclusion of customer perceptions of other factors as appropriate to market conditions.

1. Introduction

The evolution of customer loyalty in terms of how it is predicted and explained has received massive attention in the marketing literature. The focus in explaining loyalty has been on customer demographics, such as age, gender or cultural background, and customer satisfaction, specifically with service quality (Baumann, Burton, Elliott and Kehr, 2007) measured by the SERVQUAL scale (Parasuraman et al., 1991). As a result, the literature is rather ‘stuck’ in the traditional ‘satisfaction leads to loyalty’ narrative. However, Kumar et al. (2013) conclude in their literature review of customer loyalty research that many research papers demonstrate that the effect of satisfaction on loyalty is in fact weak, suggesting an exploration into new drivers of loyalty. Further, the services marketing literature has given only minimal attention to the complexity of the often non-linear relationship (Baumann et al., 2012b) between satisfaction and loyalty; a relationship that also suggests that satisfaction alone cannot fully explain loyalty. For example, in the airline industry, low cost carriers typically have very low satisfaction levels, but repeat purchasing is astonishingly high. At the same time, for full service airlines, satisfaction levels are much higher but these carriers are losing market share.

7. Conclusion

Our study advances the general understanding of customer loyalty in financial services by the incorporation of customer perceptions of competitiveness, risk, regulation and stability, moving away from modelling customer loyalty based primarily on customer satisfaction with service quality. The key finding in this study is that competitiveness is capable of explaining customer loyalty in both steady and volatile markets for domestic retail banking. The study suggests that competitiveness in the financial services industry impacts both behavioral loyalty and future intentions mediated by perceptions of regulation. In contrast, the other hypothesized mediator, perceptions of stability played a surprisingly unimportant role, given that the study investigated customer loyalty in financial services. The study provides empirical support for theoretical arguments that service quality does not fully explain customer loyalty.