ABSTRACT

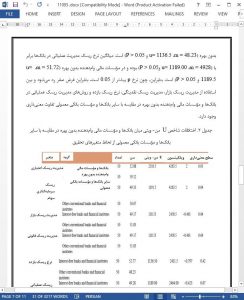

This present study has been done to compare risk management differences in banks and interest-free loan financial institutes with other conventional banks and financial institutes of Iran. This study is descriptive-comparative and cross-sectional in terms of time criteria (longitudinal - cross sectional). The questionnaire by Javadi and Qouchifard (2009), which translated and validated by researcher, was used to collect data. Population consisted of all banks, interest-free loan financial institutes and other conventional and financial institutes of Iran. Due to limited number of population (100 institutes and banks), it was divided in two groups (banks and interest-free loan financial institutes) as samples. Research results based on U Mann-Whitney Test showed that there were remarkable differences in using credit risk management, capital investment on stocks and liquidity risk management in banks, interest-free loan financial institutes and other conventional banks and financial institutes. But there were no significant differences in using market risk management, return risk rate, and methods of operational risk management in banks, interest-free loan financial institutes and other conventional banks and financial institutes of Iran.

1. INTRODUCTION

Banks face with various risks but the most dangerous one is credit risk in financial and banking area which means losing profit due to non-committed borrowers to its contract. The risk happens when the borrower is not able to pay principal and interest of Debt regularly or avoid to pay debts (Tejarat Bank Control Risk Administration, 2006). Excessive loan with no assessment and predictions have been led to increasing non-credit worthy customers and deferred loans. Financial crisis (2007-2008) made it clear that for banks capabilities and increasing their new capitals, it is very important and vital to understand the risk through financial markets (Seltman, 2007).

4. DISCUSSION AND CONCLUSION

The present study has been done to compare the differences between risk management in banks and interest-free loan financial institutes with other banks and conventional financial institutes of Iran. The results of research theories showed that there is significant difference between credit risk management in banks and interest-free loan financial institutes and other banks and conventional financial institutes of Iran. The result is similar to the previous research results by Shabani and Rastkhiz (2012) that have been analyzed the risks of conventional banking and interest-free banking based on Islamic contracts, and they reported no significant difference in conventional banking risks and interest-free banking risks, except two cases: Liquidity risk and operational risk. Qaderi, Charfedin and Youssef (2015), studied about Islamic banking and traditional banking in countries of Persian Gulf Cooperation Council and showed that Islamic banking has more profit and less credit risk in average.