ABSTRACT

Currently several industries including like banking, finance, retail, insurance, publicity, database marketing, sales predict, etc are Data Mining tools for Customer Relationship Management. Leading banks are using Data Mining tools for customer segmentation and benefit, credit scoring and approval, predicting payment lapse, marketing, detecting illegal transactions, etc. The Banking and Retail industry is realizing that it is possible to gain competitive advantage deploy data mining. For retailers, data mining can be used to provide information on product sales direction, customer buying tradition and desires; etc. This article provides an critique of the concept of Data mining and Customer Relationship Management in organized Banking and Retail industries. It also discusses standard tasks involved in data mining; evaluate various data mining applications in different sectors.

I. INTRODUCTION

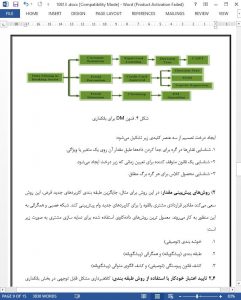

Data mining refers to computer-aided pattern discovery of previously unknown interrelationships and recurrences across seemingly unrelated attributes in order to predict actions, behaviours and outcomes. Data mining, in fact, helps to identify patterns and relationships in the data [1]. DM also refers as analytical intelligence and business intelligence. Because data mining is a relatively new concept, it has been defined in various ways by various authors in the recent past. Some widely used techniques in data mining include artificial neural networks, genetic algorithms, K-nearest neighbour method, decision trees, and data reduction. The data mining approach is complementary to other data analysis techniques such as statistics, on-line analytical processing (OLAP), spreadsheets, and basic data access. Data mining helps business analysts to generate hypotheses, but it does not validate the hypotheses.

V.CONCLUSION AND FUTURE WORK

Data mining is a tool used to extract important information from existing data and enable better decision-making throughout the banking and retail industries. They use data warehousing to combine various data from databases into an acceptable format so that the data can be mined. The data is then analyzed and the information that is captured is used throughout the organization to support decision-making. It is universally accepted that many industries (including banking, retail and telecom) are using data mining effectively. Undoubtedly, data mining has many uses in industries. Its practical applications in such areas as analyzing medical outcomes, detecting credit card fraud, predicting customer purchase behavior, predicting the personal interests of Web users, optimizing manufacturing processes etc. have been very successful. The retail industry is also realizing that data mining could give them a competitive advantage. Those banks and retailers that have realized the utility of data mining and are in the process of building a data mining environment for their decision-making process will reap immense benefit and derive considerable competitive advantage to withstand competition in future