Abstract

The Taiwanese government offers firms that invest in qualified projects in emerging high-tech industries two mutually exclusive tax incentives—a corporate 5-year tax exemption or shareholder investment tax credits. This study examines whether corporate managers take shareholder tax benefits into account in their corporate tax planning. The results show that privately held firms are more likely than listed firms to choose shareholder investment tax credits and forego corporate tax benefits. Listed firms with relatively high earnings response coefficients tend to choose a corporate 5-year tax exemption, as it can enhance reported after-tax earnings. Further, in the 5-year period following their choice of a particular tax incentive, firms choosing a corporate 5-year tax exemption exhibit significantly lower earnings persistence than those choosing shareholder investment tax credits. Taken together, these results suggest that stock market pressure has a significant effect on firms’ choices between corporate and shareholder tax benefits, and that the choice of tax incentives has an effect on future earnings quality.

1. Introduction

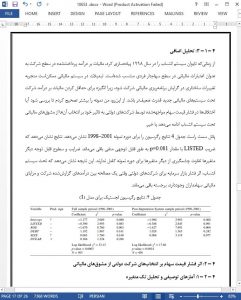

To promote technological advancement, the Taiwanese government provides two mutually exclusive tax incentives to stimulate investment in qualified high-tech industries.1 Companies that invest in the qualified industries can select either a 5-year exemption from corporate income tax on income derived from those investments or they can pass the tax incentive to their shareholders by granting shareholders investment tax credits of up to 20% (for corporate shareholders) or 10% (for individual shareholders) of the qualified investment amount.2 As only one of the two alternatives can be selected, the choice of tax incentive is an important tax planning decision as to whether firms should keep the tax benefit at the corporate level or pass it to their shareholders. In Taiwan, the overall tax revenue losses resulting from these two tax incentives during the 1999–2005 period amounted to about US$3.6 billion.3 The magnitude of the tax-savings from the two tax incentives is so significant that the choice between the two alternatives is generally regarded as one of the most important tax planning decisions made by managers in Taiwan.

5. Conclusions and limitations

This study investigates the role of stock market pressure in the trade-off between corporate and shareholder tax benefits. The direct examination of firm managers’ choice of two mutually exclusive alternative tax incentives indicates that privately held firms are more likely than listed firms to choose shareholder investment tax credits and forego corporate tax benefits. Listed firms with high ERCs are more likely than listed firms with low ERCs to choose a corporate 5-year tax exemption, as it can enhance reported after-tax earnings. This study further examines the consequences of different types of tax incentives on financial reporting quality. The results show that in the 5-year period following their choice of tax incentives, firms choosing a corporate 5-year tax exemption exhibit significantly lower earnings persistence than those choosing shareholder investment tax credits. The results suggest that stock market pressure has a significant effect on firms’ choice of tax incentive and that the choice of tax incentive affects future earnings quality, as proxied by earnings persistence.