Abstract

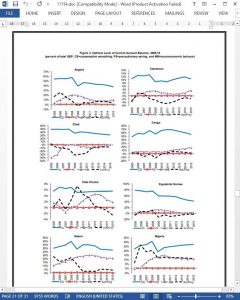

In the extensive empirical work carried out across the IMF on oil-producing sub-Saharan African (SSA) countries, the notion of “sustainability” is often directed toward fiscal policies, and, in particular, views on the “optimal” non-oil primary fiscal deficit. The bulk of this work does not, however, address external sustainability, which is a concern especially for those SSA oil producers operating under a fixed exchange rate regime. A couple of recent papers have extended the existing methodologies to assess external sustainability for some oil-producing countries but they do not focus on those in sub-Saharan Africa. In this paper, we bolster this empirical work by providing a range of estimates for the long-run external current external account balance for each of the SSA oil-producing countries, based on three widely used methodologies in the IMF. Our research strategy is to apply these models to the eight countries in the subregion—Angola, Cameroon, Chad, Côte d’Ivoire, Equatorial Guinea, Gabon, Nigeria, and the Republic of Congo—using similar simplifying assumptions so that we are using the same lens to view how they do and do not differ.

I. INTRODUCTION

In the extensive empirical work carried out across the IMF on oil-producing sub-Saharan African (SSA) countries, the notion of “sustainability” is often directed toward fiscal policies, and, in particular, views on the “optimal” non-oil primary fiscal deficit.2 The bulk of this work does not, however, address external sustainability, which is a concern especially for those SSA oil producers operating under a fixed exchange rate regime. A couple of recent papers have extended the existing methodologies to assess external sustainability on some oil-producing countries but they do not focus on those in sub-Saharan Africa.

VI. CONCLUSIONS

By their very nature, estimates of long-term external sustainability are subject to wide variability and uncertainty. In this paper, we elaborate on the sources of this variability and uncertainty through estimates of long-term sustainability based on different models; we believe that we can establish a clearer view of the current situation compared with where the eight SSA oil-producing countries—Angola, Cameroon, Chad, Côte d’Ivoire, Equatorial Guinea, Gabon, Nigeria, and Republic of Congo—might want to be.

The actual current account balance in these eight countries could be considered “close” to the optimal only if we are looking through the rear-view mirror. This is suggested by the results of the macroeconomic balance approach, which is a backward-looking analysis. It also indicates that the countries have had backward looking policies in the past and now need to shift to forward-looking policies. There is also a sense of urgency, because without new discoveries the time horizon for oil production is dwindling.