Abstract

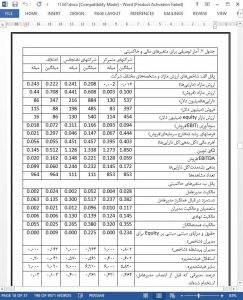

We find that diversified firms in New Zealand are associated with a value discount of 19–42 per cent relative to single-segment (undiversified) firms. Although several competing explanations have been offered in the literature, we find that the strength of corporate governance explains between 15–21 per cent of this discount. Specifically, board size, busyness of directors, CEO ownership and whether or not compensation of directors includes equity-based components collectively explain a large part of the reported discount. Our results from companies trading in New Zealand complement recent findings in the US by not only confirming the existence of a diversification discount but also emphasizing the role of poor governance in destroying shareholder wealth by pursuing a value-destroying corporate strategy. All our results hold after controlling for potential endogeneity in the decision to diversify and the choice of corporate governance structure by employing two-way fixed-effects and dynamic-panel generalized method of moments regression techniques.

1. Introduction

Research spanning the last three decades suggests that markets value conglomerates differently relative to single-segment (undiversified) firms. Finance theory attributes these differences to both costs and benefits that can result from operating as a conglomerate. For example, diversification can be beneficial if it leads to lower bankruptcy costs (Amihud and Lev, 1981), lower taxes through increased debt capacity (Lewellen, 1971), or when it leads to more efficient resource allocation (Myers, 1977). Conversely, diversification can be costly if it leads to cross-subsidization of unprofitable units (Meyer et al., 1992; Rajan et al., 2000), when agency conflicts induce managers to engage in non-value maximizing diversification such as rent seeking (Scharfstein and Stein, 2000) or when managers engage in value-destroying investments for personal gains (Murphy, 1985; Denis et al., 1997; Lins and Servaes, 2002).

6. Conclusions

We examine and analyze corporate diversification’s impact on firm value and the role of corporate governance in explaining cross-sectional variation in valuation differences between diversified and focussed firms on a recent sample of NZ listed companies. Employing the widely accepted Berger and Ofek (1995) methodology we find that, consistent with international evidence, diversified companies in NZ also suffer a value discount ranging from 19 per cent for the assets-based to 42 per cent for the sales-based measures of excess values relative to single-segment firms. Additionally, consistent with Hoechle et al. (2012), there is a strong cross-sectional association between several variables that proxy for the strength of corporate governance and both the level of diversification and the associated discount. When variables that proxy for the strength of corporate governance are introduced into the model, the magnitude of the discount declines by 21 and 15 per cent for the assets and sales based measures respectively. Given the decision to diversify and choice of governance structure could potentially be endogeneously determined, we conduct our analyses to control for endogeneity issues by employing two-way fixed effects and dynamic panel GMM estimation techniques. All our results are robust to alternative methods of constructing the control variables, an alternative measure of the degree of diversification and an alternative excess value measure.