Abstract

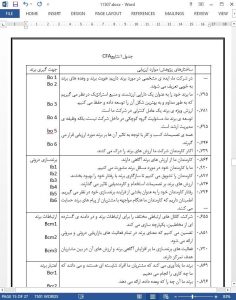

Purpose: This study aims to examine the relationship between brand orientation and financial performance in business-to-business (B2B) small- and medium-sized enterprises (SMEs). It examines the impact of brand-oriented strategy on financial performance through four branding constructs, namely internal branding, brand communication, brand awareness, and brand credibility.

Design/methodology/approach: A questionnaire-based survey was conducted to collect data from 250 Finnish B2B SMEs. Confirmatory factor analysis is performed to examine the validity of the constructs, while structural equation modeling is used to test proposed hypotheses of the study.

Findings: The results suggest that brand orientation improves the effectiveness of brand communication and internal branding in building brand awareness and credibility. Brand awareness emphasizes an external route through brand communication, while brand credibility emphasizes an internal route through internal branding. Brand awareness positively impacts on brand credibility, and brand credibility positively impacts on financial performance— highlighting the importance of both brand performance components for financial performance.

Originality/value: This study addresses the research gap in the B2B branding literature regarding the role of branding in enhancing financial performance. The results suggest that brand-oriented strategy can contribute to financial performance through brand awareness and brand credibility in the context of B2B SMEs.

1. Introduction

Branding is one of the successful concepts of marketing science. Business-to-business (B2B) branding research shows that a strong brand provides several strategic benefits for industrial suppliers, including brand extension, referrals, distribution power, premium prices, and stronger buyer–supplier relationship (Leek and Christodoulides, 2011; Glynn et al., 2007; Gupta et al., 2010). However, “limited empirical attention has been paid to investigate the role of B2B branding in enhancing market share, as well as financial and economic performance” (Seyedghorban et al., 2016, p. 2674). Financial performance is important for B2B firms because they are concerned whether their brand-building investments will reward them financially (Leek and Christodoulides, 2011). The B2B small- and medium-sized enterprises (SMEs) are particularly skeptical because of limited financial and operational resources (Hirvonen et al., 2016; Merrilees et al., 2011).

7.3. Limitations and future research recommendations

This study inherits some limitations, even though the data provides solid support for the model. First, the response rate, although on a par with some similar B2B studies, was relatively low. This low response rate may lead to non-response errors, which in turn may potentially bias the estimation of parameters. Second, this study only drew sample from Finnish B2B SMEs, making the findings generalizable to this specific section of companies. Future research is recommended to examine the model in other contexts; for example, in other countries or in non-B2B sectors. By testing the model in these contexts will shed lights on how well the model performs in broader contexts. Moreover, a longitudinal study tracking the changes of the impact of brand-oriented strategy on firm performance is recommended. Finally, future studies could also examine and compare how other strategic orientations (for example: technology orientation, customer orientation) affect the financial performance in B2B SMEs.