Abstract

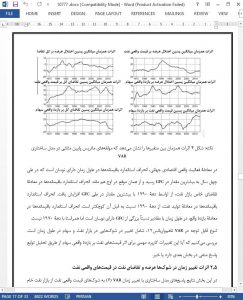

A mixture innovation time-varying parameter VAR model is used to examine the impact of structural oil price shocks on U.S. stock market return. Time variation is evident in both the coefficients and the variance–covariance matrix. The standard deviations of the demand side structural shocks reached forty year peaks during the global financial crisis and have remained high since. In the real stock return equation the coefficient of global real economic activity has declined since the late 1990s and that of oil-market specific demand oil shock has been lower since the early 1990s than before. The structural oil shocks account for 25.7% of the long-run variation in real stock returns overall, with substantial change in levels and sources of contribution over time. The contribution of shocks to global real economic activity to real stock return variation rose sharply to 22% in 2009 (and remains 17% over 2009–2012). The contribution of oil-market specific demand price shocks rose unevenly from 5% in the mid-1970s to about 15% in 2007, with a subsequent decline. The contribution of oil supply shocks has trended downward from 17% to 5% over 1973–2012.

1. Introduction

Hamilton (2013) notes that major change has taken place in the global oil market since the early 1970s with fluctuations in the real price of oil, movement in the sources of demand for oil, and shifts in oil production due to geopolitical events, changes in economic motivations, technologies, and resources. Baumeister and Peersman (2013a) demonstrate that the volatility of the real price of crude oil has been higher since 1986 and that the volatility of global oil production has trended downwards over the last thirty-five years.

Blanchard and Gali (2009) argue that there has been a change in the causal relationship between oil price and the economy, in that increases in oil price are linked with smaller movements in output and inflation in recent years than in the 1970s. Blanchard and Riggi (2013) document that these changes are due to more efficient use of oil, lower real wage rigidity, and better monetary policy. It has been noted by a number of researchers that there has been structural change over time in the macroeconomy. Sims and Zha (2006) find that the variance of the exogenous shocks has changed overtime and Primiceri (2005) and Koop et al. (2009) find that in addition, the parameters connecting the variables have also evolved over time. In an analysis of the commodity market, Narayan et al. (2013) find that commodity (including oil) market profits are regime dependent and contingent on structural breaks. In the literature review it is noted that much of the oil price-stock return literature finds structural shifts, time varying volatility, and changes and nonlinearity in the relationship between oil prices and stock returns over time.

6. Conclusion

Study of the important connections between the oil and financial markets has generated a substantial body of work. Improved understanding of these relationships has potentially significant implications for better understanding of the real and financial economy. Much of the literature has noted that the key connections between oil and financial markets and the real economy have been changing over time. A substantial literature on the oil pricestock return relationship notes structural shifts, time varying volatility, and nonlinearity over time. We believe that it is crucial in assessing the effect of an oil price shock that the source of the shock be identified and that the sources of time variation are investigated for both the coefficients and the variance covariance matrix of the innovations.