Abstract

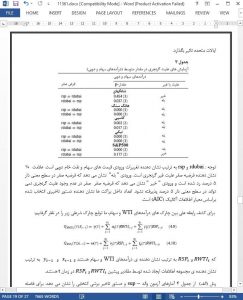

This paper considers the causal relationships between WTI and Dubai crude oil returns and five stock index returns (S&P 500, Nikkei, Hang Seng, Shanghai, and KOSPI) within the quantile causality framework by using daily data for a period from January 1, 1996, to October 12, 2012. The quantile causality test is useful for a comprehensive understanding of the causal relationship between two returns. The test reveals several noteworthy results. First, although WTI returns are not closely related to Asian countries, some financial markets such as Nikkei and Hang Seng Granger-cause WTI returns. Second, the significance of causality from one market to another derives only from lower and upper levels of quantiles except for the case of causality from Nikkei to WTI returns. Third, all stock index returns Granger-cause Dubai crude oil returns over almost all quantile levels except for Shanghai returns. Fourth, Dubai crude oil returns Granger-cause all Asian stock index returns except for S&P 500 returns. Finally, the results indicate asymmetric causality from Dubai crude oil returns to Shanghai returns and KOSPI returns to Dubai crude oil returns.

1. Introduction

Crude oil is a vital source of energy for the world and continuesto play a prominent role for many decades to come, although some progress has already been made in finding alternative energy sources. Because crude oil is the main input for producing products, it is clear that its price has considerable direct or indirect influence on the economy. For example, an increase in oil prices can directly affect consumers by raising fuel costs for vehicles. In addition, this increase can reduce the profitability of firms highly dependent on oil, thereby influencing their stock prices because the increase raises production costs. Therefore, it is important to determine whether this argument holds empirically in the real world.

5. Concluding remarks

This paper investigates the causal relationship between crude oil and stock markets from the perspective of quantile causality. The results of the quantile causality test indicate that the significant causal relationship between WTI and stock returns derives from tail quantile intervals. The results imply that when one financial market faces extreme conditions, it is likely to be affected by another market. This suggests that investors should be cautious about information from oil markets when stock markets are under extreme conditions. In addition, oil-dependent firms should hedge against risks from oil price fluctuations in a bear or bull market. Finally, governments should develop appropriate policy measures to minimize systemic risk in the oil stock system under extreme conditions.