Abstract

Extant literature on the antecedents of university spin-off (USO) business performance has developed with the aim of highlighting those drivers that could foster the performance of such firms, focusing on a variety of factors. Less interest has been devoted to the market orientation–performance relationship, despite the positive link frequently found in the marketing literature. The aim of the present paper is therefore to fill this gap and investigate the relationship between market orientation (MO) and USO performance using the Netval database of Italian research spin-offs. To measure MO, we adopted an ad hoc questionnaire, and after testing its validity with a factor analysis, we performed a regression model. The results show that MO, particularly some of its components (customer intelligence generation, intelligence dissemination, integration and inter-functional coordination), has an impact on business performance. This contribution presents some valuable research implications useful for academics, but professionals from new high-tech ventures and technology transfer offices may also benefit from this knowledge.

Summary highlights Contributions: The study offers a better understanding of the span of applicability of Market Orientation (MO) concept. While most of the previous studies examined larger companies, our study focuses on university spin-offs (USOs), offering empirical evidence of the positive relationship between MO and business performance in the context of new ventures stemming from academic departments and research laboratories. Moreover, by testing a scale for measuring the level of MO in USOs, it offers a research tool that might be used in future studies on other countries or comparative analyses.

Conclusions

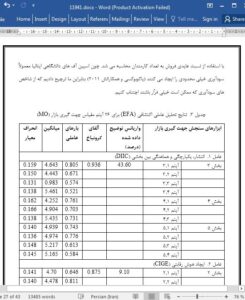

In this study, we tried to extend previous literature on university spin-offs with two principal aims: understanding the MO dimensions relevant for USOs, through the development of a valid measuring scale of the MO construct for these specific companies and examining the relationship between MO and business performance. The results show that the MO construct in USOs can be split into four dimensions, but not all dimensions present the same effect on business performance. In particular, responsive customer intelligence generation (RCIG) and dissemination, integration and inter-functional coordination (DIIC) seem to positively affect business performance; proactive customer intelligence generation (PCIG) reveals a negative impact, while competitor intelligence generation (CIGE) presents a non-significant effect on business performance, with a negative trend.