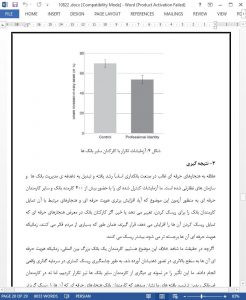

In recent years, the banking industry has witnessed several cases of excessive risk-taking that frequently have been attributed to problematic professional norms.We conduct experiments with employees from several banks in which we manipulate the saliency of their professional identity and subsequently measure their risk aversion in a real stakes investment task. If bank employees are exposed to professional norms that favor risk-taking, they should become more willing to take risks when their professional identity is salient. We find, however, that subjects take significantly less risk, challenging the view that the professional norms generally increase bank employees’ willingness to take risks.

Financial risks are inherent in most banks’ core business activities, such as investing and lending money to individuals, organizations, and governments. In recent years, however, the extent of risk-taking in the banking industry has been widely questioned. For example, there is an emerging consensus among academics and regulators that excessive risk-taking in the banking industry was a major contributor to the global financial crisis (e.g., Diamond and Rajan 2009; Financial Crisis Inquiry Commission 2011; Freixas and Dewatripont 2012). The issue of excessive risk-taking has led to active discussions among policy makers and regulators about its possible roots. Many believe that the prevailing professional norms—that is, views about acceptable behavior that are widely shared among members of a specific profession—favor excessive risk-taking by making employees less risk averse. Consequently, policy makers and regulators have called for a change in professional norms in an attempt to address the problem of excessive risk-taking (e.g., House of Commons Treasury Committee 2008; Power, Ashby, and Palermo 2013; International Monetary Fund 2014). But empirical knowledge about whether the professional norms in the banking industry reduce employees’ risk aversion has proven elusive.

3. Conclusion

Interest in the professional norms prevailing in the banking industry has grown substantially and continues to preoccupy the leadership at banks and regulatory agencies. We conducted controlled experiments with more than 400 bank employees and other professionals to examine whether an increase in professional identity saliency and associated norms changes bank employees’ willingness to take risks. If bank employees are exposed to professional norms that increase their risk appetite, as many people think, they should become more willing to take risks when their professional identity is made salient.