Abstract

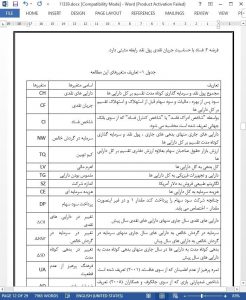

Although many prior studies document consistently negative effects of corruption on macroeconomic issues, the relationship between corruption and corporate financial decisions is debatable. In this paper, we investigate how corruption environment affects corporate cash holdings. With a sample of 199,333 observations across 46 countries, we find that corruption is positively associated with both cash holdings and the cash flow sensitivity of cash. Robustness tests with a reduced sample without US and Chinese firms, different measures of cash holdings and various regression approaches show that our research findings are stable. We also find that the effects of corruption are stronger if legal protection of shareholders is adequate. In addition, our additional analysis shows that corruption reduces value of cash. This paper shows that bribery motive of cash holdings is consistent around the world and firms tend to balance agency motive and bribery motive in their corporate liquidity management.

1. Introduction

Corruption is public officials’ behavior to exploit public power for their own benefits (Jain, 2001). Corruption undermines public trustin government, wastes public resources and causes social injustice.World Bank (2017) estimates that enterprises and individuals pay about $1.5 trillion (equivalent to 2 % of the global GDP) per year in bribes. Therefore, corruption has become one of the most problematic issues in the real world and the academic world. Several prior studies document that corruption negatively affects a wide range of macroeconomic issues namely national investment and economic growth (Brunetti et al., 1998; Doh and Teegen, 2003; Mauro, 1995; Zakharov, 2018), health care and education services (Gupta and Tiongson, 2000), foreign direct investment and economic growth (Lambsdorff and Cornelius, 2000).

7. Conclusions lthough many prior studies document consistently negative effects of corruption on macroeconomic issues, the relationship between corruption and corporate financial decisions is debatable. In this paper, we investigate how corruption environment affects corporate cash holdings. With a sample of 199,333 observations across 46 countries, we find that corruption is positively associated with both cash holdings and the cash flow sensitivity of cash. Robustness tests with a reduced sample without US and Chinese firms, different measures of cash holdings and various regression approaches show that our research findings are stable. We also find that the effects of corruption are stronger if legal protection of shareholders is adequate. In addition, our additional analysis shows that corruption reduces value of cash. This paper shows that bribery motive of cash holdings is consistent around the world and firms tend to balance agency motive and bribery motive in their corporate liquidity management.