Abstract

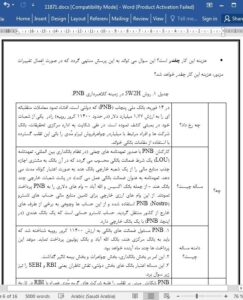

At a time when the government is aiming for bank recapitalization, the PNB scam comes as a huge blow to the entire banking sector. The Rs 12,700 crore scam involves at least six banks, raising doubts over the internal safety of operations in financial firms. It may be noted that the PSBs lost at least Rs 227 billion to bank frauds in the last five years. The magnitude of PNB scam is very exorbitant and it has been happening for more than five years undetected. This poses serious questions into the internal operations and auditing processes. The apex bank of the country RBI is facing public wrath for not being able to detect the largest banking scam. It is high time that all PSBs should review their internal process and take appropriate actions. This paper aims to identify and analyze the factors that led to this massive scam. It uses the quality tool 5W2H for analysis. This paper also delves into auditing process of the banks and possible loop-holes that led to the fraud. This paper also summarizes the impact of scam on various banks and the economy as whole.

1. Introduction

World credit market faced a huge turmoil during the financial crisis of 2007 and many big banks as in [1] and financial institutions filed for bankruptcy including Lehman brothers [2]. The impact of crisis was profound and many banks and financial institutions in US faced massive credit crunch [3]. Economists have noted that recessions accompanied by banking crises tend to be deeper and more difficult to recover from than other recessions [4].The Second largest PSU Bank in India on Feb 14th, 2018 reported fraudulent transactions worth Rs 11,400 crore to stock exchanges and law enforcement agencies. The scam which initially was estimated to 11,400 crore, now added up to 12,700 crore is nearly one-third of the Net worth of Punjab National Bank (PNB) is now termed as a country’s biggest banking fraud. The banks are already facing turmoil due to weak capital management. Eleven of India’s twenty one listed government-owned banks are now under the Reserve Bank of India’s watch due to large bad loans, weak capital levels and low return on assets. Together these banks account for over Rs. 3 lakh crore in bad loans of the total of Rs 8.4 lakh crore across India’s listed banks [5]. When the government is planning to recapitalize the banks [6] the PNB scam comes as a huge blow.