Abstract

When making investment decisions, one will face not only the risk of financial assets within portfolio but also background risk. This paper discusses an uncertain portfolio selection problem in which background risk is considered and the security returns and background assets return are given by experienced experts’ evaluations instead of historical data. Regarding the returns of the securities and background assets as uncertain variables, we propose an uncertain mean-risk model with background risk for portfolio selection and the crisp forms of the model are provided when security returns obey different uncertainty distributions. In addition, when everything else is same, it is concluded that the optimal expected return of the mean-risk model with background risk is usually smaller than that without background risk. Moreover, the relationship between the optimal solution of our model and that of the model in Huang’s paper “Uncertain Portfolio Selection with Background Risk” is discussed. Finally, numerical examples are presented to illustrate the effectiveness of the model and to show the effect of background risk on investment decision.

1. Introduction

Portfolio selection problem is to consider how to allocate one’s capital in different risky securities in order to maximize the return of portfolio with risk control. Markowitz [1] first proposed the mean–variance model in 1952, which is the foundation of modern portfolio theory and has been the most impact-making development in mathematical finance management. However, measuring the risk by the variance of return of a portfolio has some limitations. In view of this, scholars studied other methods to measure investment risk of the portfolio and built a lot of portfolio optimization models, such as, mean– semivariance model [2,3], expected absolute deviation model [4], Value-at-Risk model [5,6], Conditional Value-at-Risk models [7,8], mean–semivariance–CVaR model [9], etc. In this paper, risk curve [10] will be used as the risk measure since it provides information about all the likely losses.

4. Conclusions

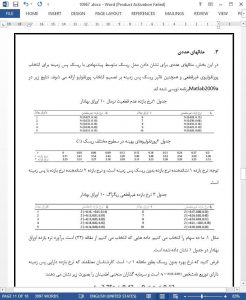

In this paper, the effect of the background risk on investments has been discussed. In the complex financial and social environment, there are situations where background assets return and the security returns have to be evaluated by experienced experts due to the unexpected things and the lack of historical data. This paper has discussed that risk level can be measured by risk curve and proposed uncertain mean-risk model with background risk for portfolio selection. The crisp equivalents of the model are provided. In addition, for any given r, we have found that the expected return of the optimal portfolio with background risk is smaller than that without background risk. Different from Huang’s model, our model can consider all the possible risks that investors could tolerate.

Finally, both the numerical examples and the analysis show that the mean-risk model with background risk is effective and background risk has a great effect on the investment decision.