Abstract

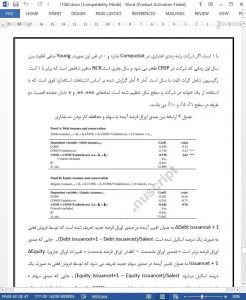

We argue that conservatism improves investment efficiency. In particular, we predict that it resolves debt-equity conflicts, facilitating a firm׳s access to debt financing and limiting underinvestment. This permits the financing of prudent investments that otherwise might not be pursued. Our empirical results confirm these predictions. We find that more conservative firms invest more and issue more debt in settings prone to underinvestment and that these effects are more pronounced in firms characterized by greater information asymmetries. We also find that conservatism is associated with reduced overinvestment, even for opaque investments such as research and development.

1. Introduction

Prior research (e.g. Biddle et al., 2009) hypothesizes and finds that accounting quality improves investment efficiency. They identify a conditional negative (positive) association between accounting quality and investment for firms operating in settings prone to overinvestment (underinvestment). We extend this line of research, similarly hypothesizing and finding a conditional negative (positive) association between conservatism and investment for firms operating in settings prone to overinvestment (underinvestment). We also find that more conservative firms in settings prone to underinvestment issue more debt and invest in more prudent projects, and that the investment and financing effects of conservatism are more pronounced in the presence of greater information asymmetries.

7. Conclusions

We study the association between conservatism and the investment efficiency of firms. We find that, in settings where firms are prone to underinvest, more conservative firms invest more and raise more debt than less conservative ones. These effects of conservatism on investment and financing are more pronounced in the presence of information asymmetries. Our empirical evidence is consistent with prior analytical work showing that conservatism facilitates access to debt (Göx and Wagenhofer, 2009). This comports with prior research that indicates that debtholders demand conservative accounting because it facilitates their monitoring. We also find that, in settings prone to overinvestment, conservatism reduces investment not only for acquisitions, as documented by Francis and Martin (2010), but also for other harder-to-monitor types of investments.